What Is a Statement of Retained Earnings? What It Includes

The balance sheet, one of the core financial statements, presents a company’s financial status at a particular point in time. It includes an overview of the company’s assets, liabilities, and shareholders’ equity. The amount of retained earnings that a corporation may pay as cash dividends may be less than total retained earnings https://www.bookstime.com/ for several contractual or voluntary reasons. These contractual or voluntary restrictions or limitations on retained earnings are retained earnings appropriations. For example, a loan contract may state that part of a corporation’s $100,000 of retained earnings is not available for cash dividends until the loan is paid.

The company undertakes no obligation to update any of these forward-looking statements. We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month. The disclosure related to accounting errors made in prior years must be corrected and reflected in the retained earning balance carried forward. If the error made does not has a financial value or practical restatement, there must be added notes about the explanation of the error and how it has been corrected. There can be different purposes of retained earnings depending on the nature of the business.

Retained earnings appropriations

For example, if you don’t invest in projects or stimulate the interest of investors, your revenue can decrease. Now, add the net profit or subtract the net loss incurred during the current period, that is, 2019. Since company A made a net profit of $30,000, therefore, we will add $30,000 to $100,000. All of the other options retain the earnings for use within the business, and such investments and funding activities constitute retained earnings. Some of that is coming through a reduction in expense reimbursements, but I don’t consider there going to be anything material in there, Steve.

Knowing financial amounts only means something when you know what they should be. That’s distinct from retained earnings, which are calculated to-date. While the term may conjure up images of a bunch of suits gathering around a big table to talk about stock prices, it actually does apply to small business owners. Retained earnings are an equity balance and as such are included within the equity section of a company’s balance sheet.

Stock Dividend Example

Retained earnings represent a company’s total earnings after it accounts for dividends. You calculate retained earnings at the end of every accounting period. Retained earnings are affected by an increase or decrease in the net income and amount of dividends paid to the stockholders. Thus, any item that leads to an increase or decrease in the net income would impact the retained earnings balance. This is the net profit or net loss figure of the current accounting period, for which retained earnings amount is to be calculated.

In a business landscape where long-term sustainability is key, retained earnings stand as a testament to a company’s ability to balance immediate shareholder rewards with future ambitions. Determine the type of error made in the prior period and find the correction required. It can be additional journal entries, retained earnings represents or sometimes it requires adjustment in retained earnings. Revise and restate the financial statements of previous years to reflect the changes. The concept of retained earnings is similar to a saving account or an emergency fund kept to pay the long-term expenses of a company or a large purchase.

Importance of Retained Earnings for Small Businesses

For this reason, retained earnings decrease when a company either loses money or pays dividends and increase when new profits are created. After conducting our analysis of the underlying collateral, we have concluded – we have not recorded any specific reserves with respect to these investments. We continue to proactively monitor the health of our portfolio, and we rely on the depth and breadth of our manager capabilities to drive positive asset management outcomes while protecting shareholder value.

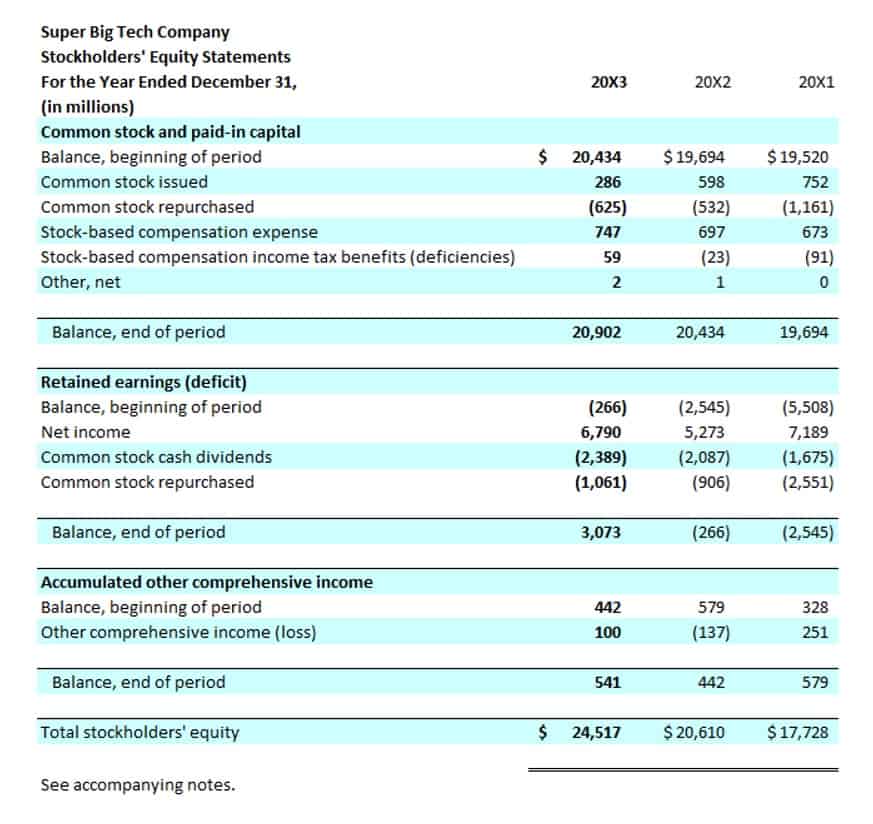

Changes in appropriated retained earnings consist of increases or decreases in appropriations. When total assets are greater than total liabilities, stockholders have a positive equity (positive book value). Conversely, when total liabilities are greater than total assets, stockholders have a negative stockholders’ equity (negative book value) — also sometimes called stockholders’ deficit.

Free Accounting Courses

Where cash dividends are paid out in cash on a per-share basis, stock dividends are dividends given in the form of additional shares as fractions per existing shares. Both cash dividends and stock dividends result in a decrease in retained earnings. The effect of cash and stock dividends on the retained earnings has been explained in the sections below.

Retained earnings are any profits that a company decides to keep, as opposed to distributing them among shareholders in the form of dividends. Dividends can be paid out as cash or stock, but either way, they’ll subtract from the company’s total retained earnings. For instance, a strategic decision to invest heavily in expansion could also lead to a short-term decrease in retained earnings but may result in higher profits in the future. Dividends refer to the share of profits that a company distributes to its shareholders. Dividends are typically distributed from the company’s current or retained earnings.

The retained earnings formula

Retained earnings are a part of net income, but it does not correspond to only the income of the current financial period. It is an accumulation of all the historical profits percentages kept in the company’s reserves for different purposes. However, the comprehensive income, Preparation of Financial statements, and Presentation of Financial Statements dictate the measurement, classification, and recognition of a company’s retained earnings. Retained earnings appear in the shareholders’ equity section of the balance sheet. During the growth phase of the business, the management may be seeking new strategic partnerships that will increase the company’s dominance and control in the market. The surplus can be distributed to the company’s shareholders according to the number of shares they own in the company.

- Essentially, it’s the portion of net profits not paid out as dividends but instead reinvested in the core business or kept for future use.

- The retained earnings are recorded under the shareholder’s equity section on the balance as on a specific date.

- Finally, calculate the amount of retained earnings for the period by adding net income and subtracting the amount of dividends paid out.

- In the long run, such initiatives may lead to better returns for the company shareholders instead of those gained from dividend payouts.

- A combination of dividends and reinvestment could be used to satisfy investors and keep them excited about the direction of the company without sacrificing company goals.

- It’s also a key component in calculating a company’s book value, which many use to compare the market value of a company to its book value.

- You can use them to further develop your business, pay future dividends, cover any debt, and more.